Target users

- Entity Representative

- Individual User

- KYC Analyst

- Compliance Officer

A Scalable Solution for Global Banking

To simplify and elevate KYC workflows using AI-driven automation enabling faster decisions, enhanced accuracy, and regulatory confidence.

User has some needs, priorities when interacting with the Website or application. We categorised features according to each user group

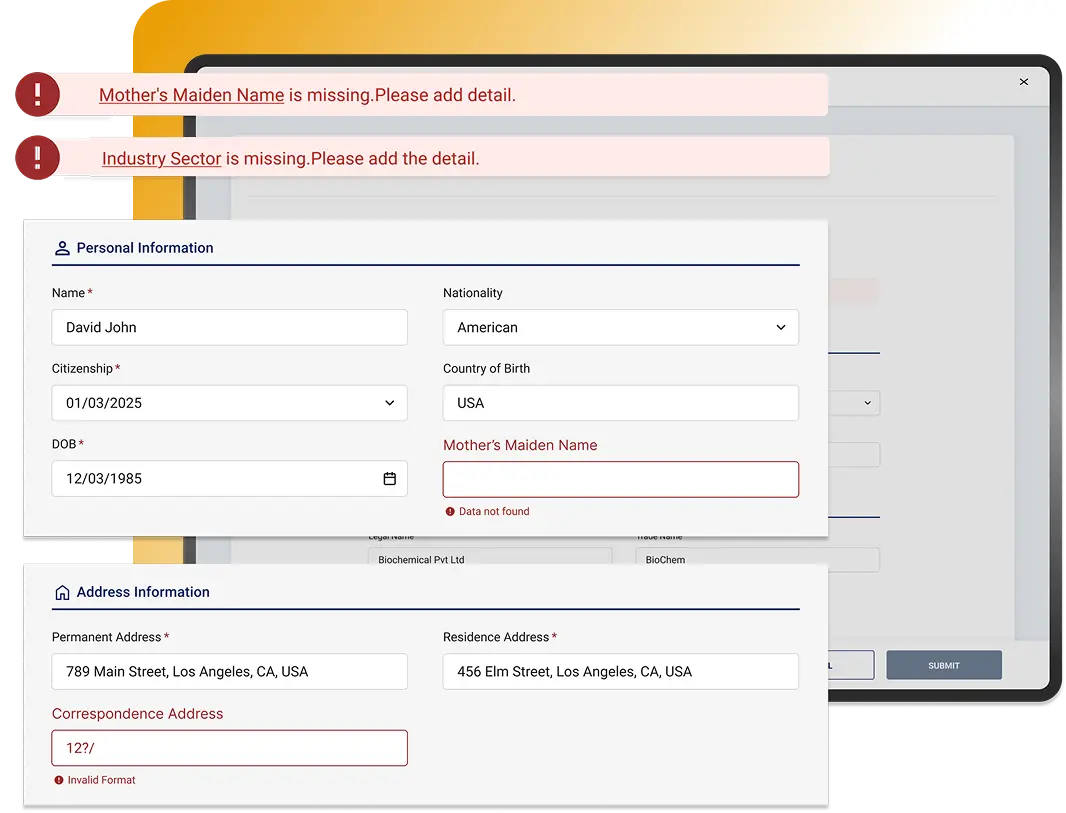

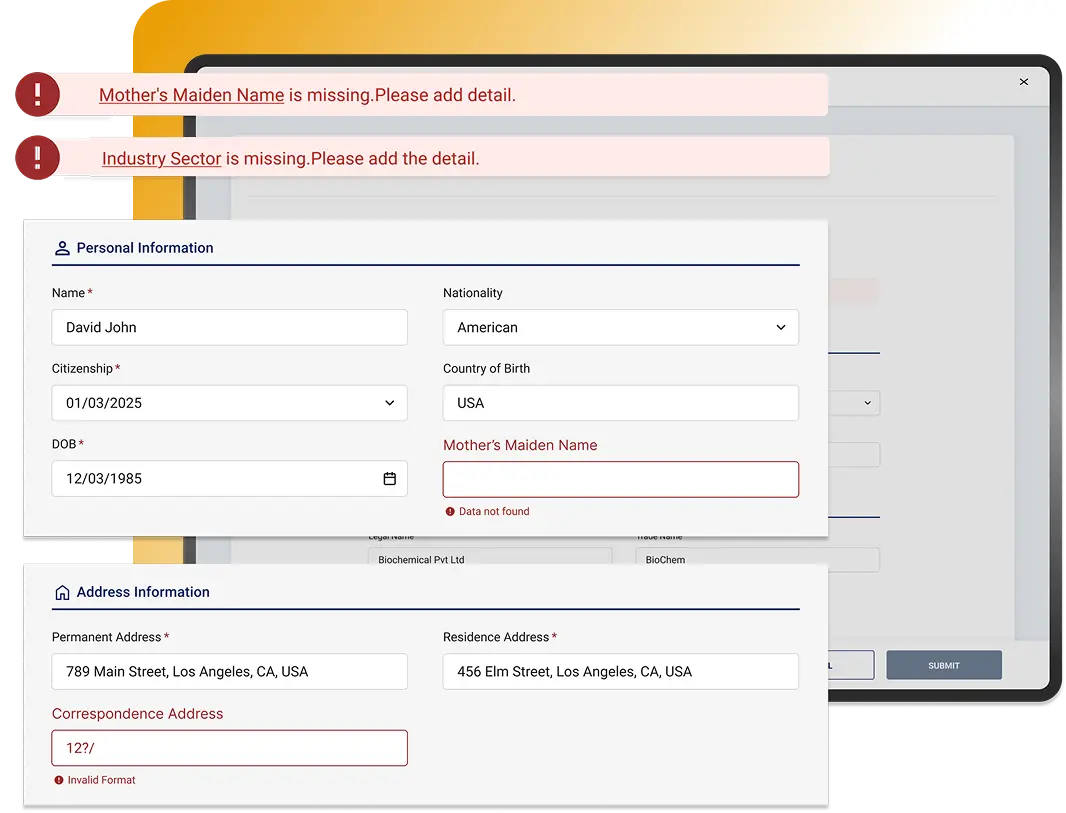

Users don’t want to read — they want toact. Inline feedback and progressive disclosure improve usability.

Clear, consistent visuals reduce user anxiety and increase submission success.

From entity representatives to compliance officers, role-based interactions must feel intuitive.

Unifying Complex, Error-Prone KYC Workflows into an Intelligent Onboarding System and document review process.

We explored user behaviors, challenges, and compliance needs across key user groups to define experience priorities and opportunities.

Enhancing accuracy, efficiency, and insights across the KYC journey with AI integration.

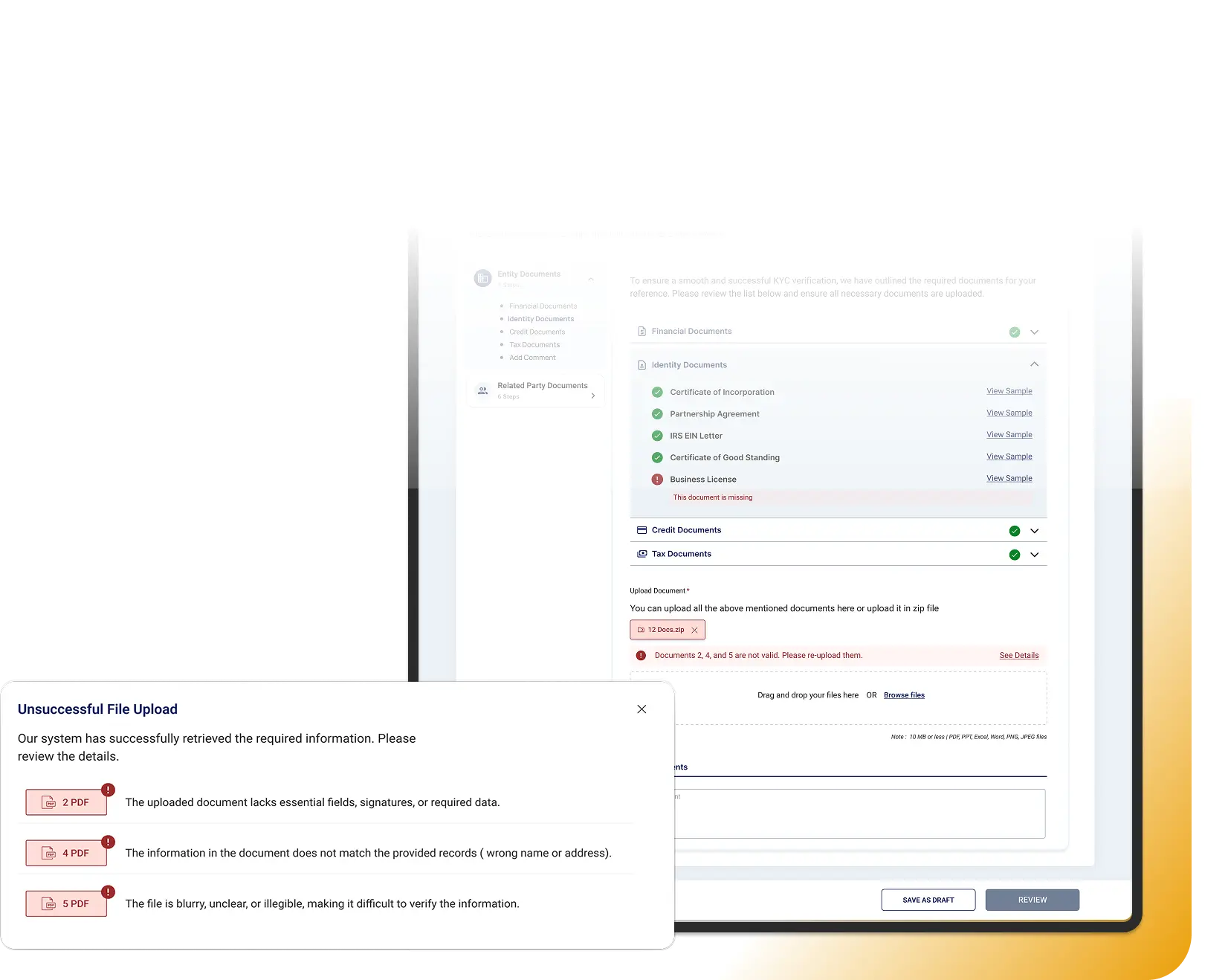

AI auto-scans uploaded files, flags errors with reasons, and extracts key data from valid documents.

Analysts can generate and review Lexis Nexis reports directly within the system, supporting deeper identity verification and risk profiling.

Gen AI evaluates all documents and reports to assign a risk rating. It also generates contextual, human-like comments to guide analyst decisions.

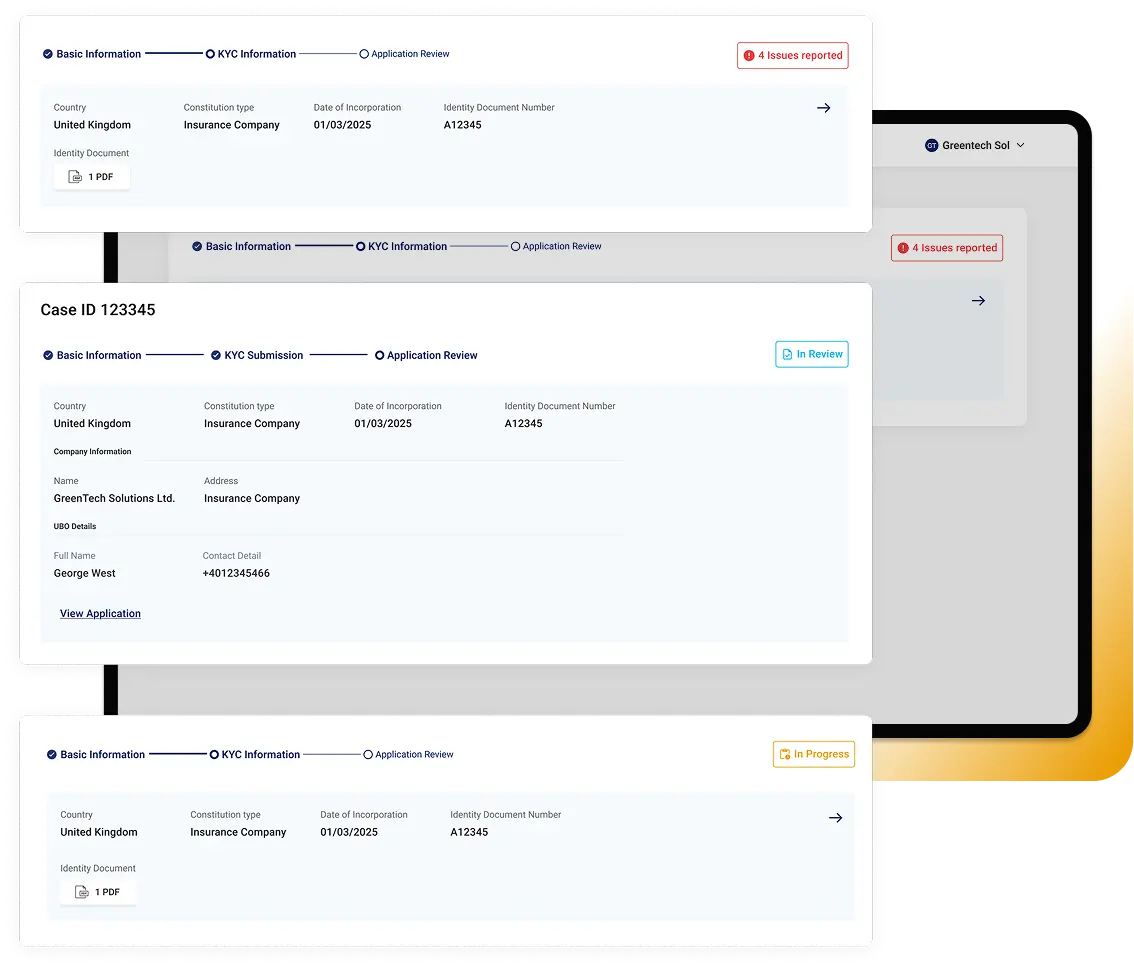

Users land on a simplified dashboard that highlights key KYC metadata — like entity type, incorporation date, and document count — along with any pending issues. It serves as a centralized, scannable entry point to resume or review the KYC process.

The form intelligently groups related fields (e.g. entity and company information) and highlights errors immediately — allowing a smooth data entry experience that minimizes rework.

Al powers every step of the segmented KYC upload flow, instantly analyzing documents on upload. it flags errors like missing data or format issues in real time, enabling immediate corrections. This smart feedback loop accelerates and improves K/C accuracy with minimal manual effort.

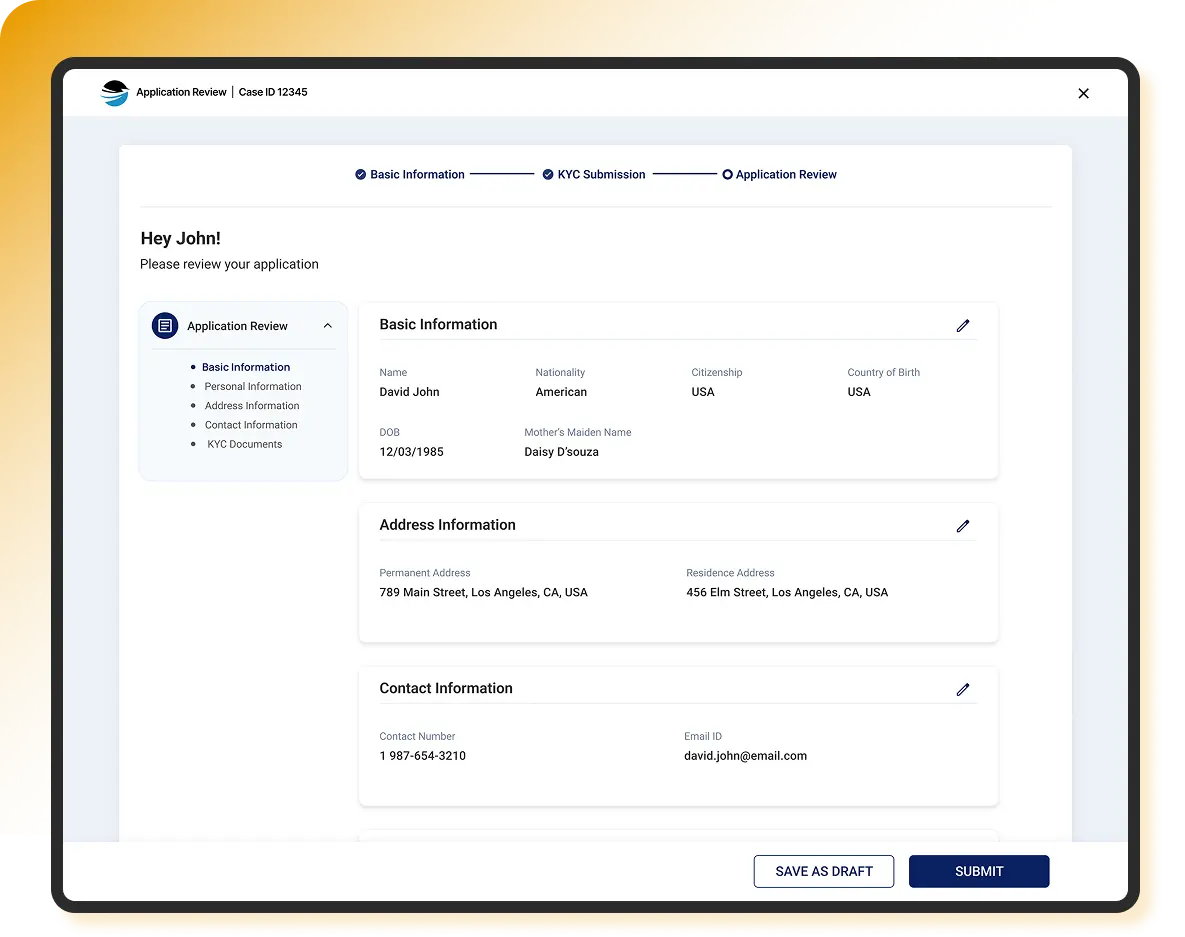

Before submitting, users can review all entered and uploaded data in a clean, grouped format. Key information is presented in a digestible layout, enabling users to verify completeness and accuracy with confidence.

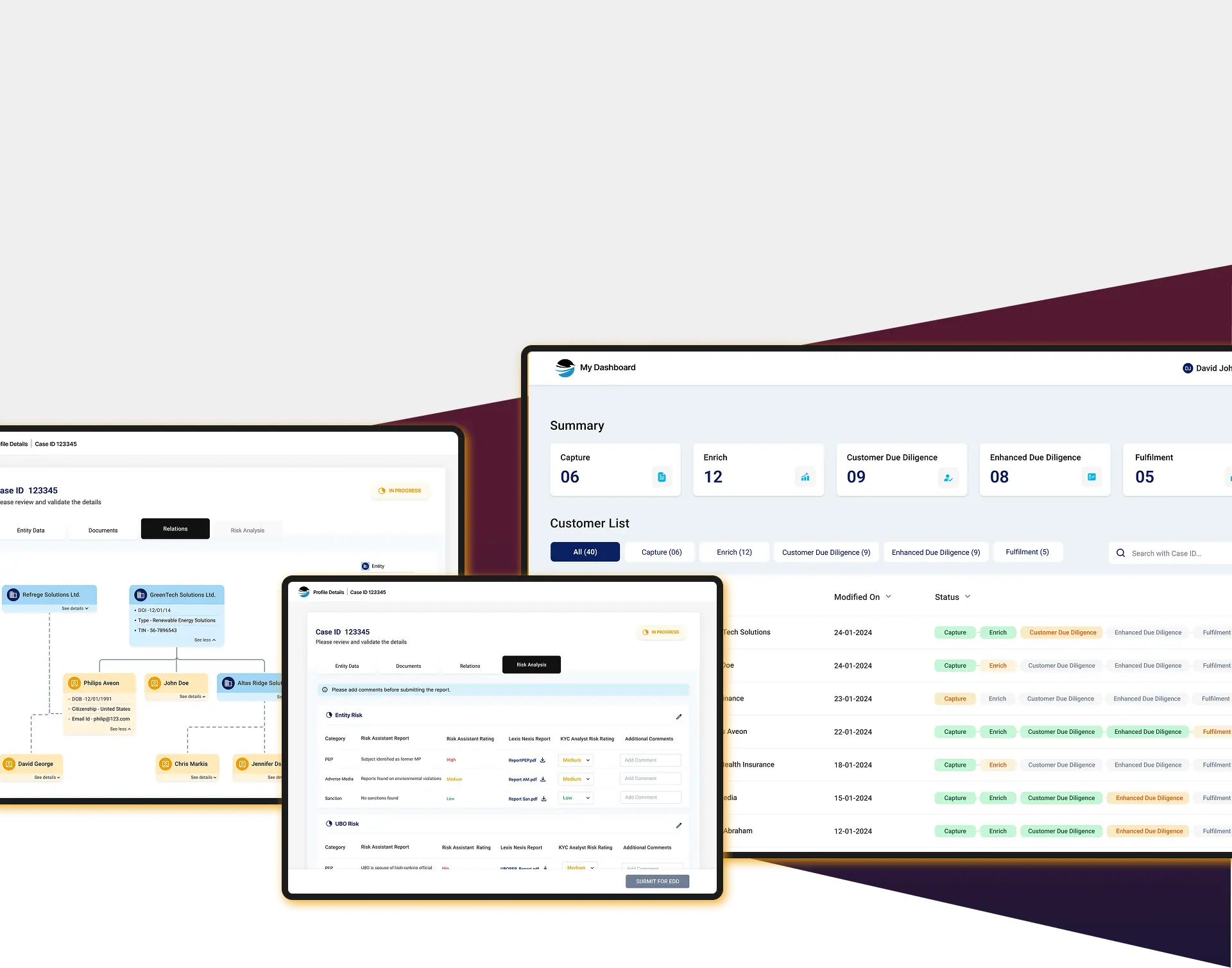

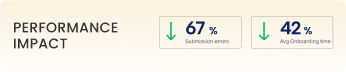

A streamlined dashboard gives a quick view of all KYC cases with smart AI-based sorting. Key details like entity type, last update, and progress stages are clearly shown, allowing analysts to track, filter, and act on cases efficiently.

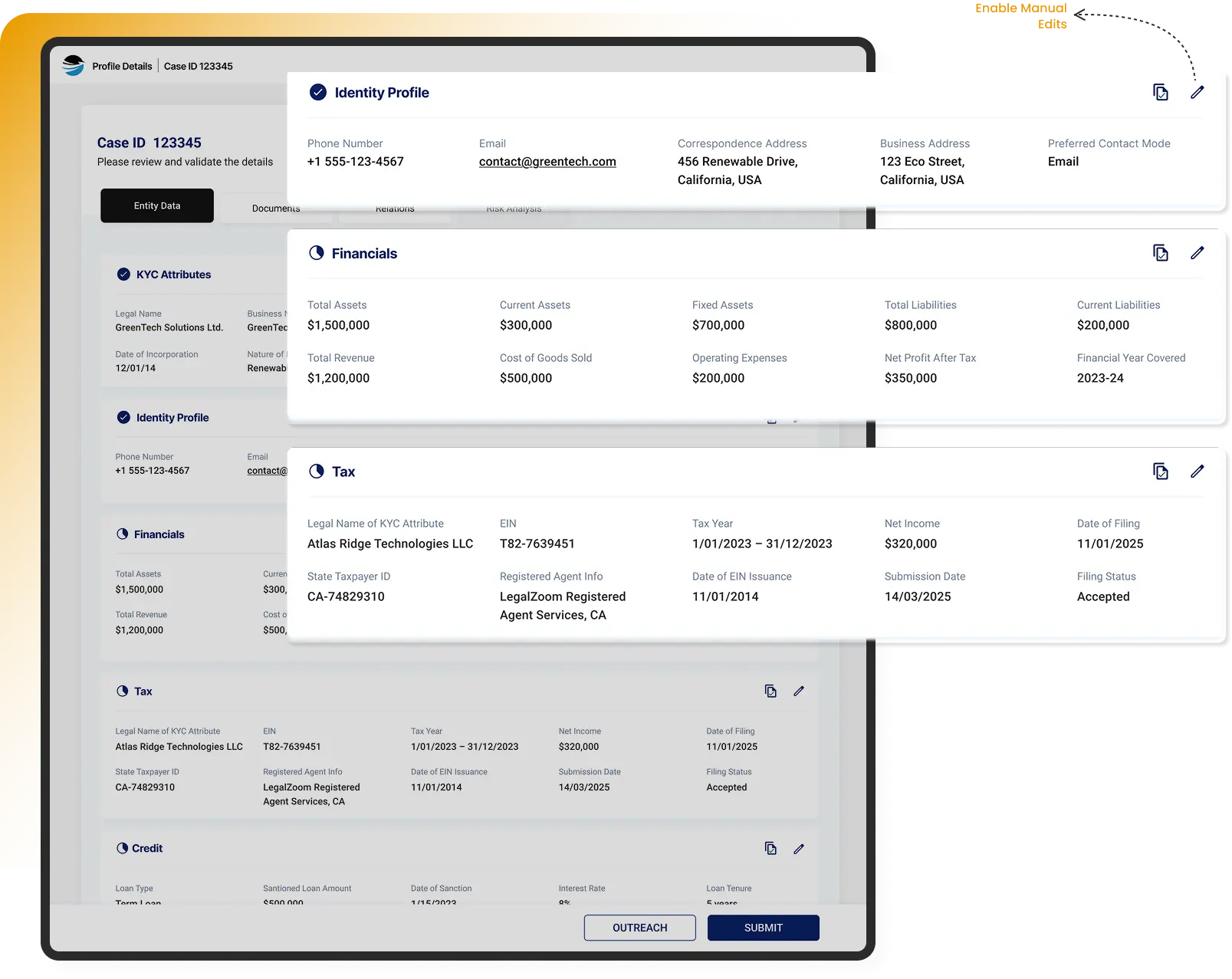

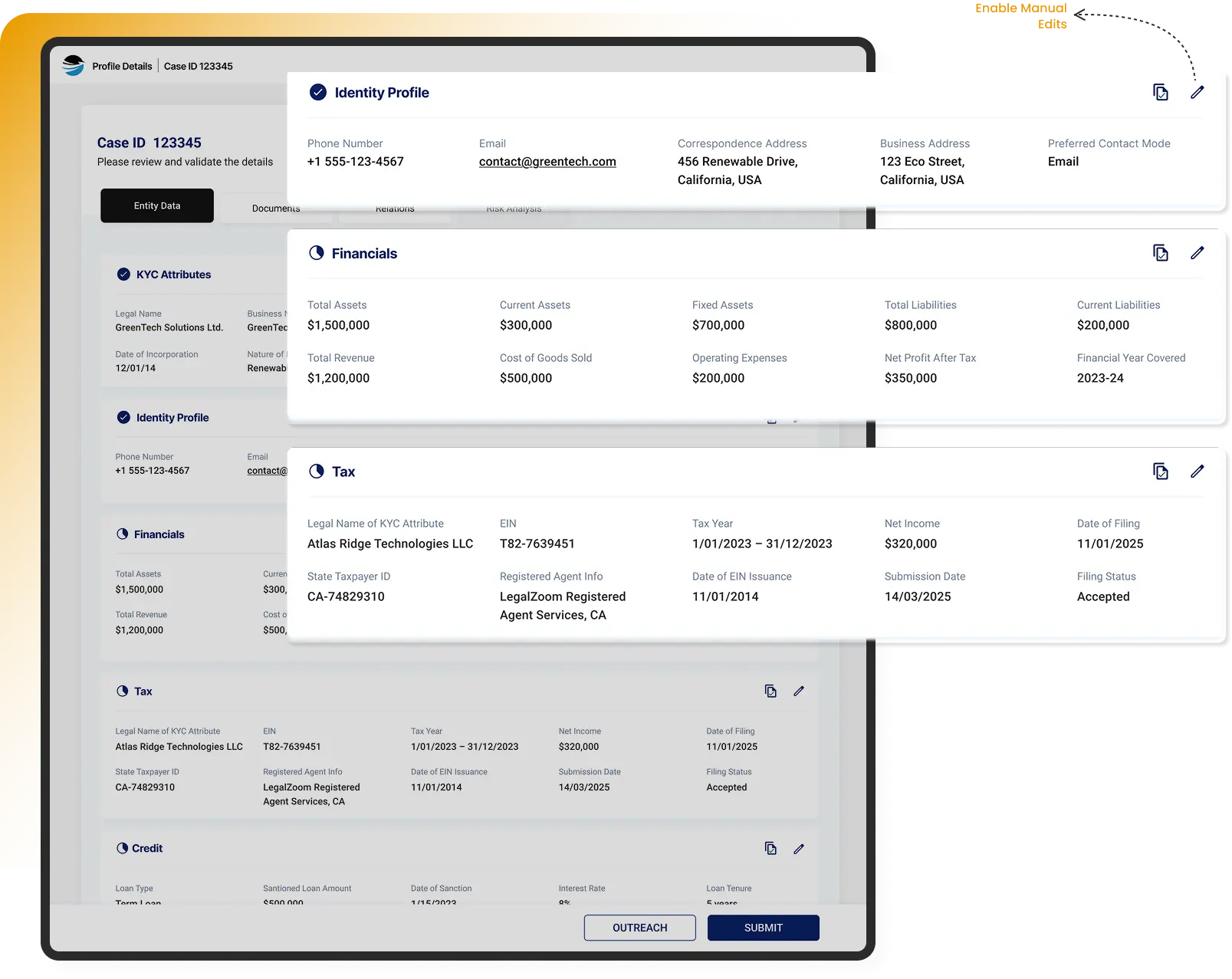

The profile page displays a clean, card-based layout where key document types—Identity, Financials, Tax, are smartly sorted by AI for quick review. Analysts can easily scan structured data and enable manual edits when needed to address discrepancies, ensuring accuracy and control before submission.

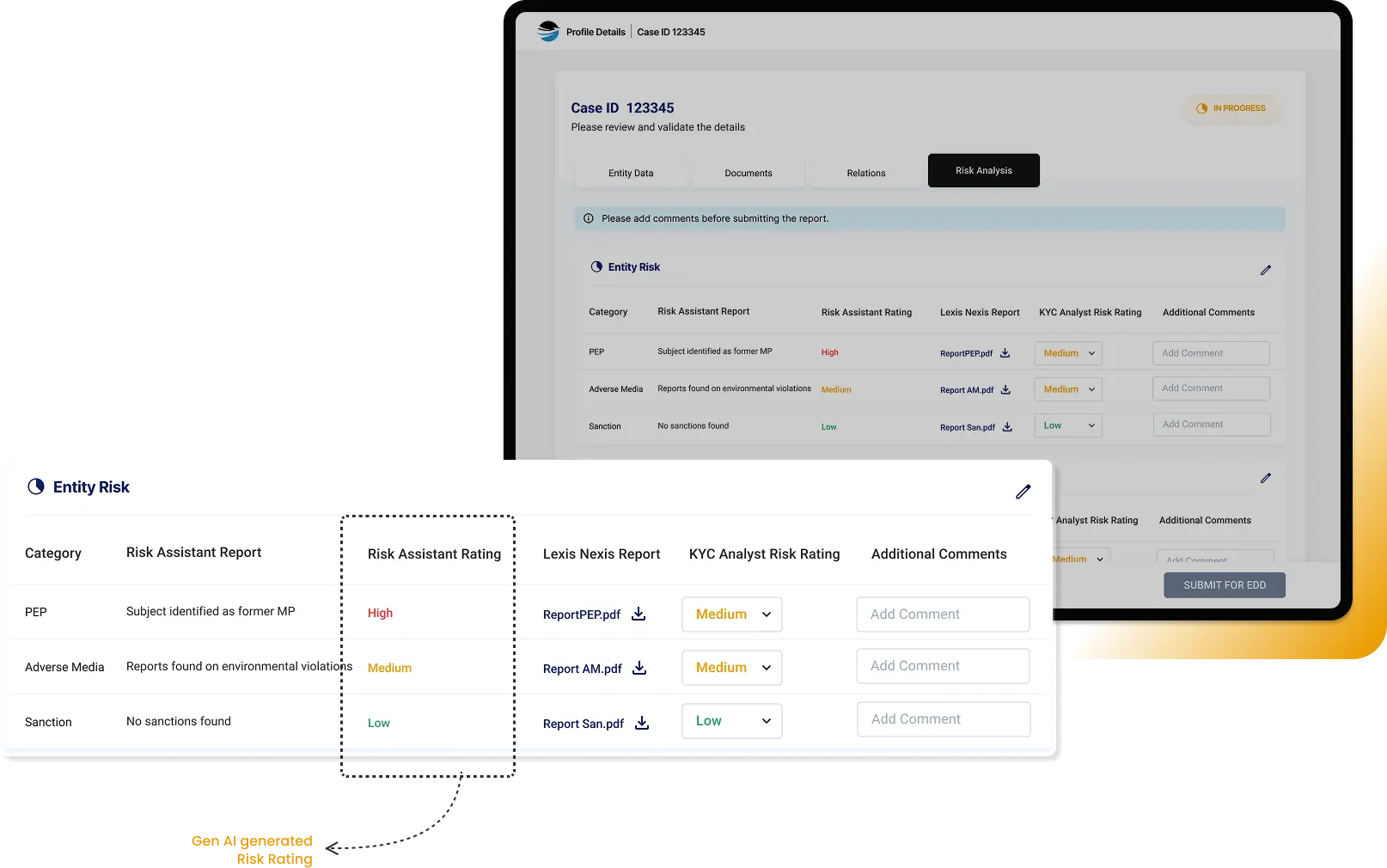

Gen AI assigns preliminary risk ratings across categories like PEP, Adverse Media, and Sanctions. Analysts can review AI-generated scores, access supporting reports (e.g., Lexis Nexis), adjust ratings, and add contextual comments—streamlining the path to EDD submission.

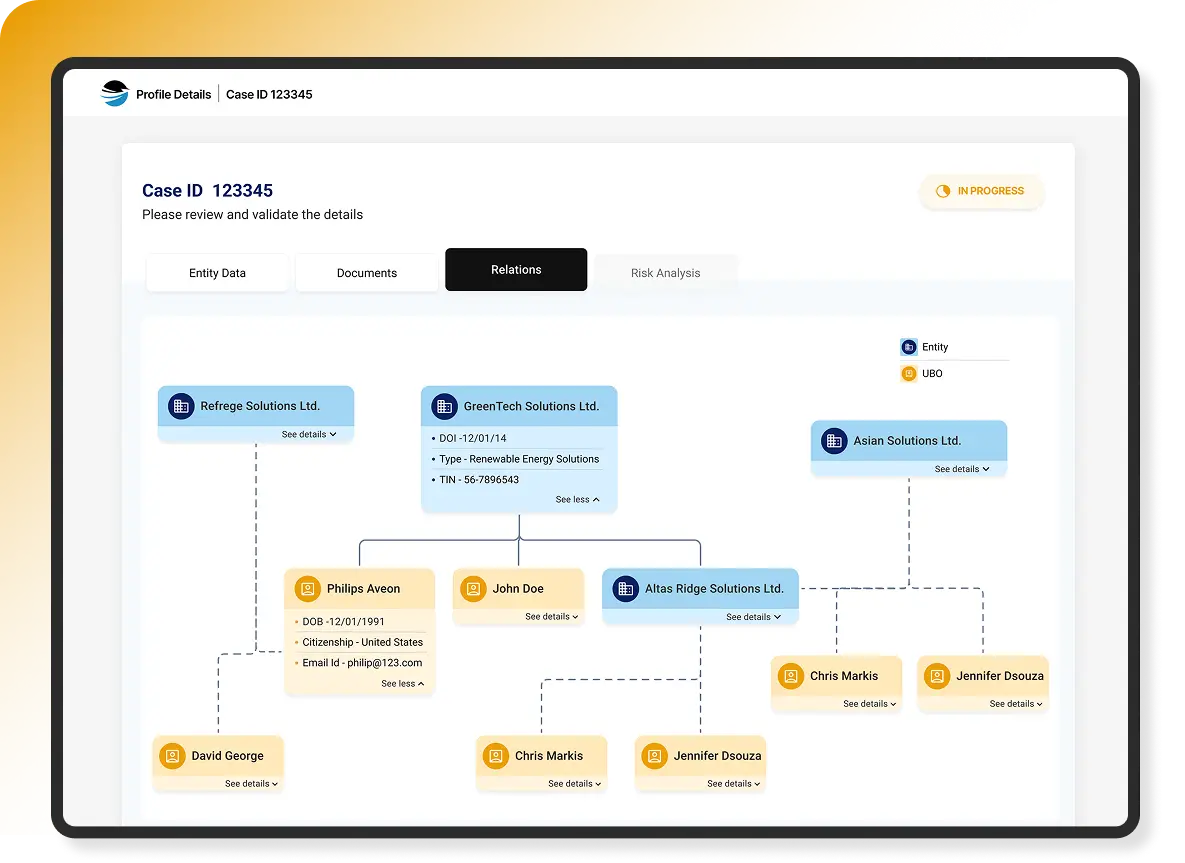

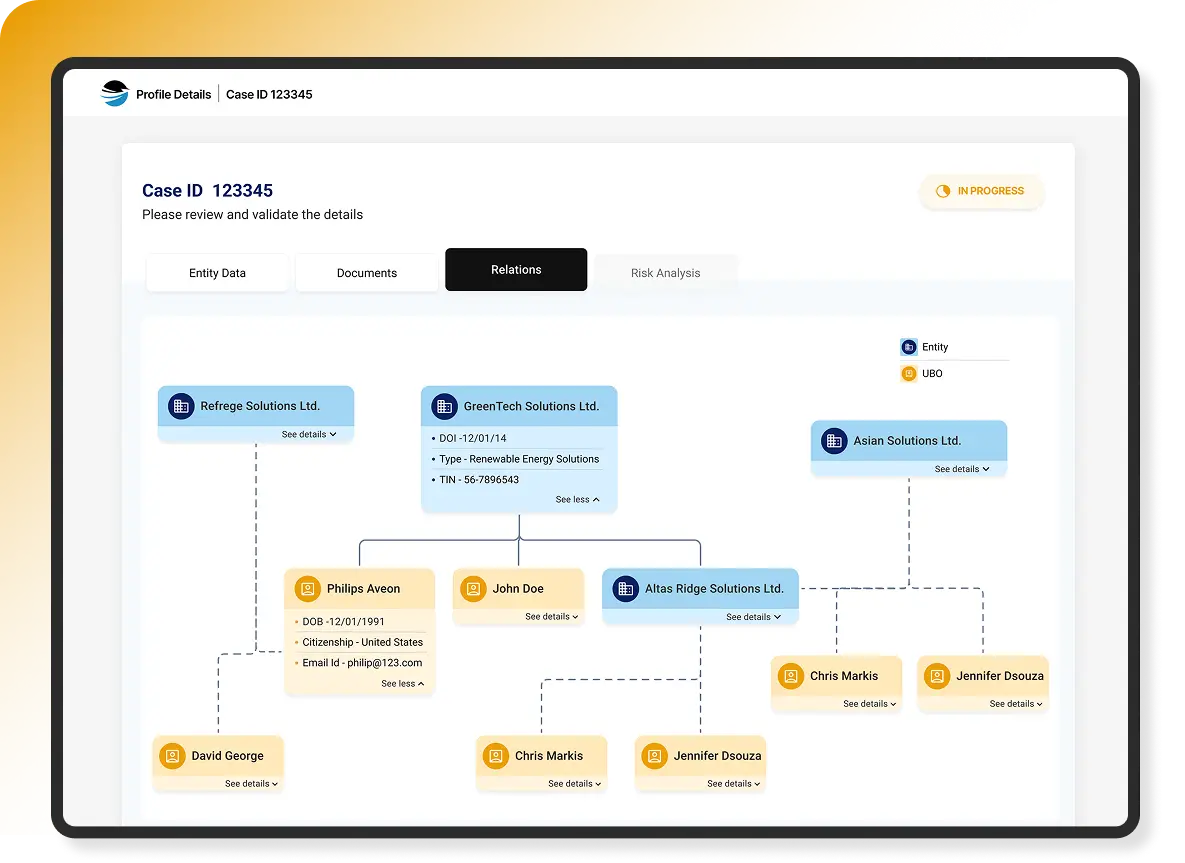

An interactive map showcasing entity and UBO relationships, enabling quick validation of ownership structure and key connections before submission.

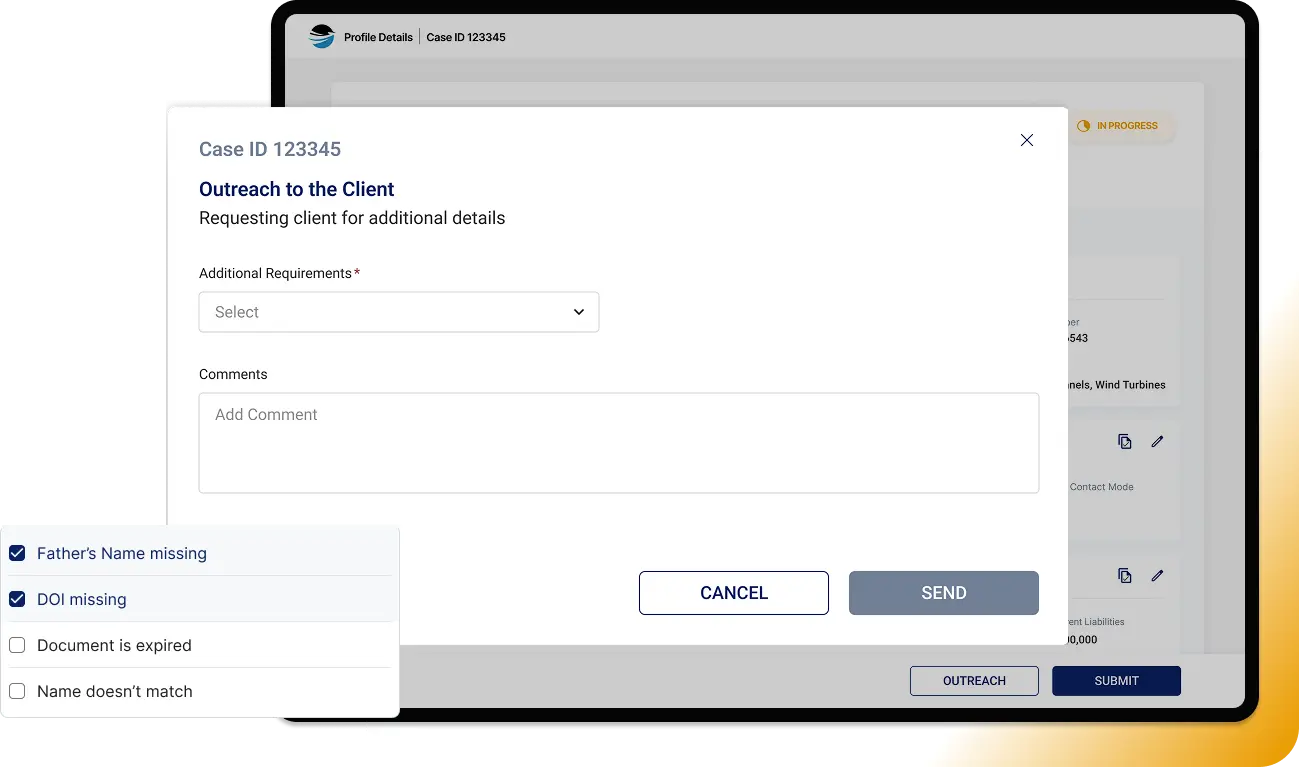

Users can quickly flag missing or incorrect KYC details and request specific updates from clients through a streamlined, centralized form ensuring faster issue resolution and clearer communication.

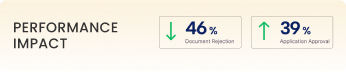

The traditional KYC process was fragmented, document-heavy, and prone to user errors due to poor feedback and unclear structure. Through reimagining the experience, we streamlined the information architecture, introduced real-time validation, and designed role-based, task-focused interfaces.

As a result, average onboarding time was reduced by 42%, document submission errors dropped by 67%, and review cycles were shortened by 28%, delivering a compliant, efficient, and user-friendly KYC journey that modernized both functionality and user experience.

Schedule a Meeting