The story

OakNorth Bank was built on the foundations of frustrations. Rishi Khosla and Joel Perlman studied together and in 2005, they tried to get capital for their data analytics company, called Copal Amba.

One of the biggest hurdles at Copal was the capital. UK banks weren’t willing to lend them despite their obvious success. Why was it so difficult for a profitable business with impressive cashflow, retained clients, and clear commercial success to get a loan?

The industry was too focused on financials from the past, rather than potential in the future.

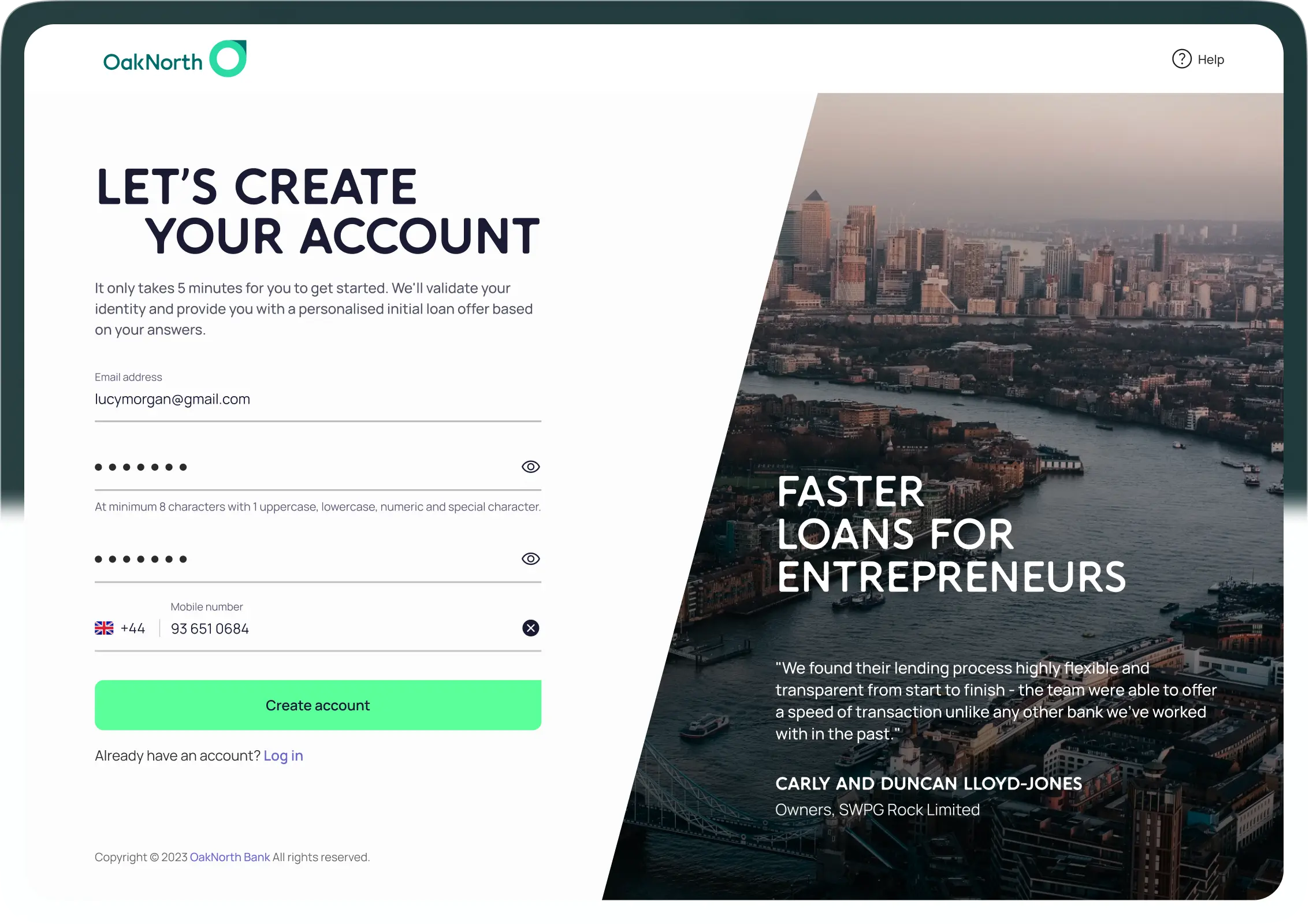

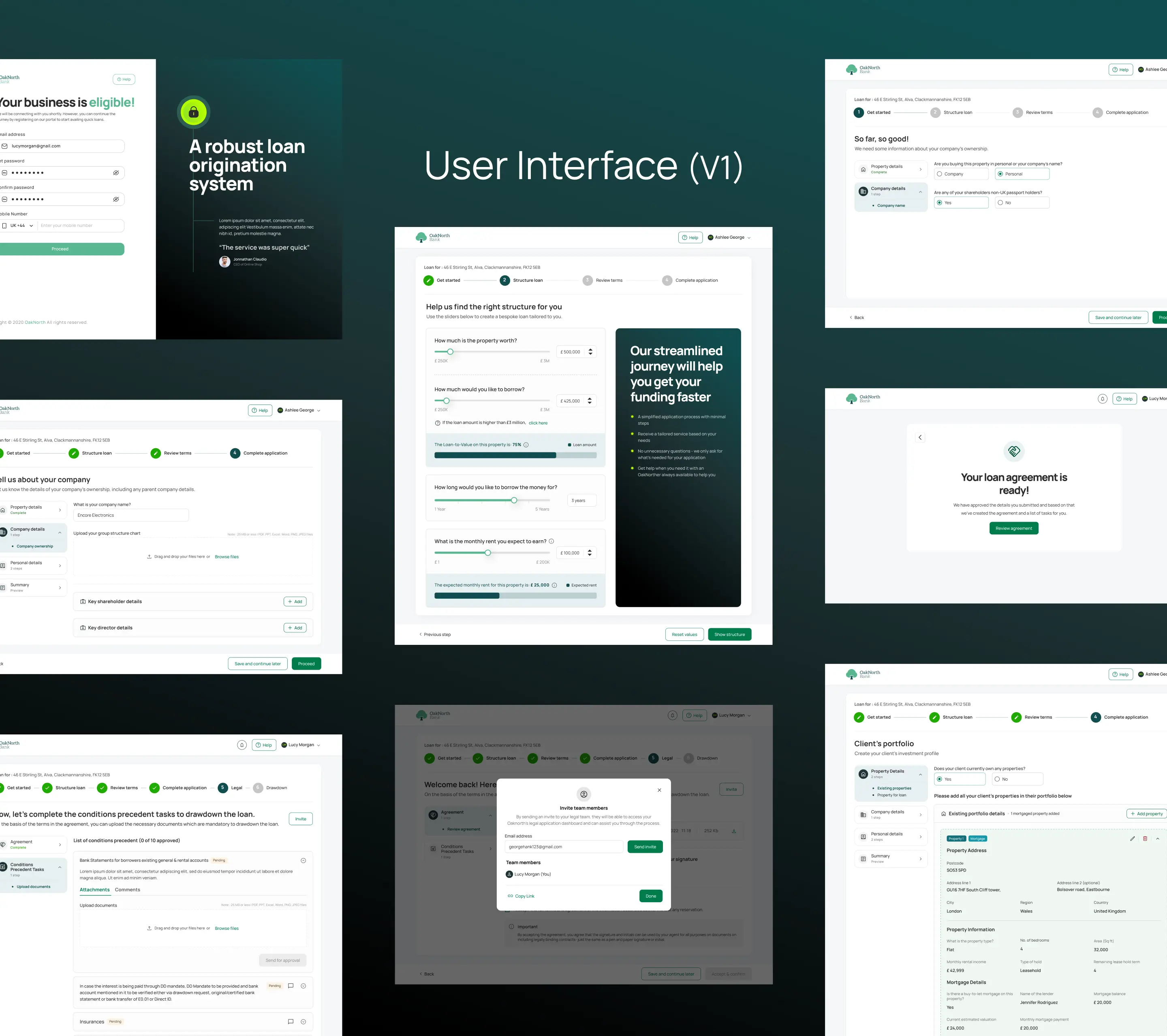

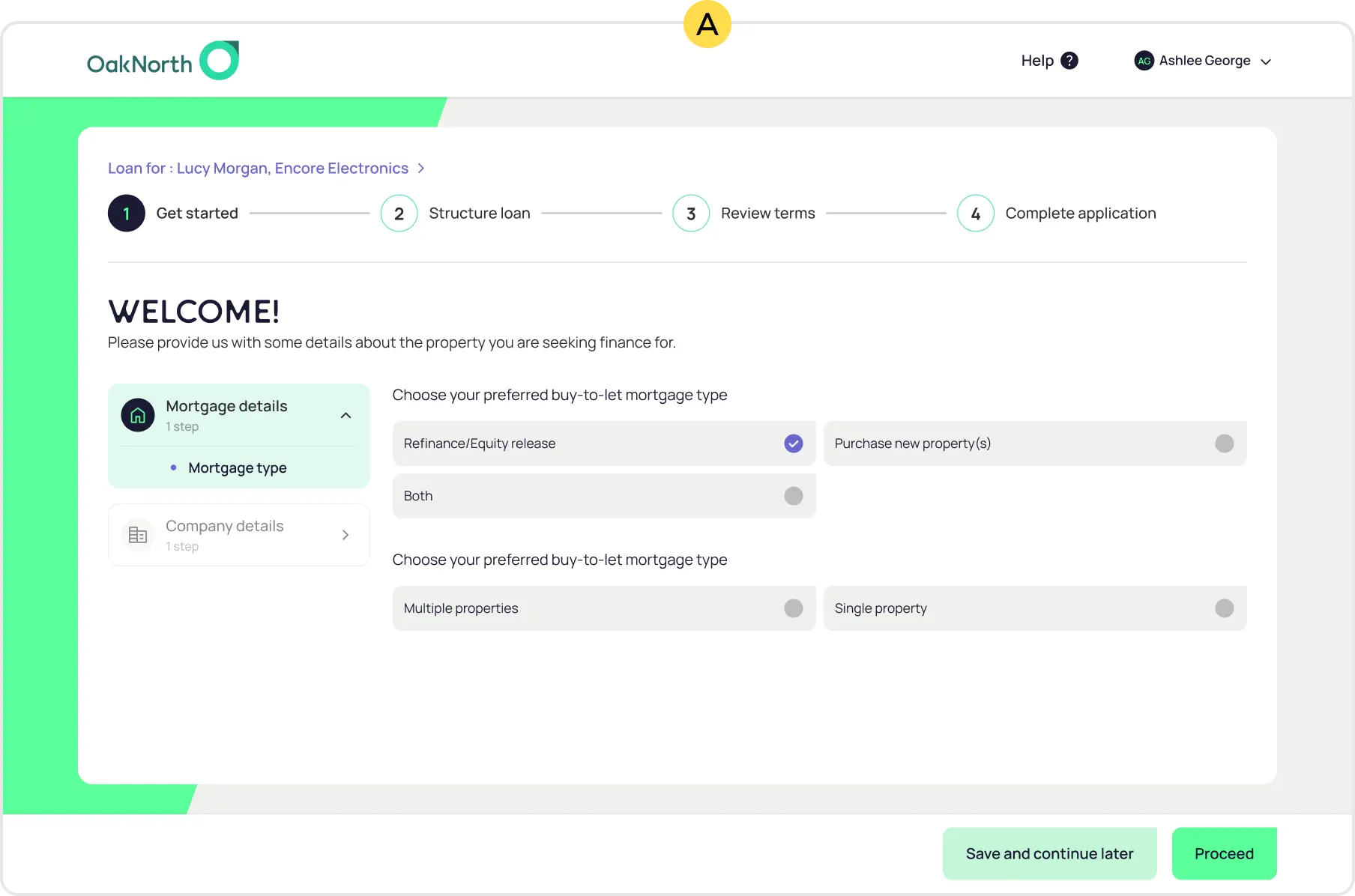

So, what if there was a bank, founded by entrepreneurs, for entrepreneurs? Hence, they decided to come up with the lending portal that solved this problem.